Are you searching for the best balanced advantage funds in India 2025 to achieve steady, risk-managed growth? These funds dynamically adjust between equity and debt, ensuring stability during volatile markets and growth during bullish runs.

In this article, we’ll explore the Top 5 Best Balanced Advantage Funds in India 2025, analyze their performance, and understand why they stand out as the best performing balanced advantage funds for long-term wealth creation.

What Are Balanced Advantage Funds?

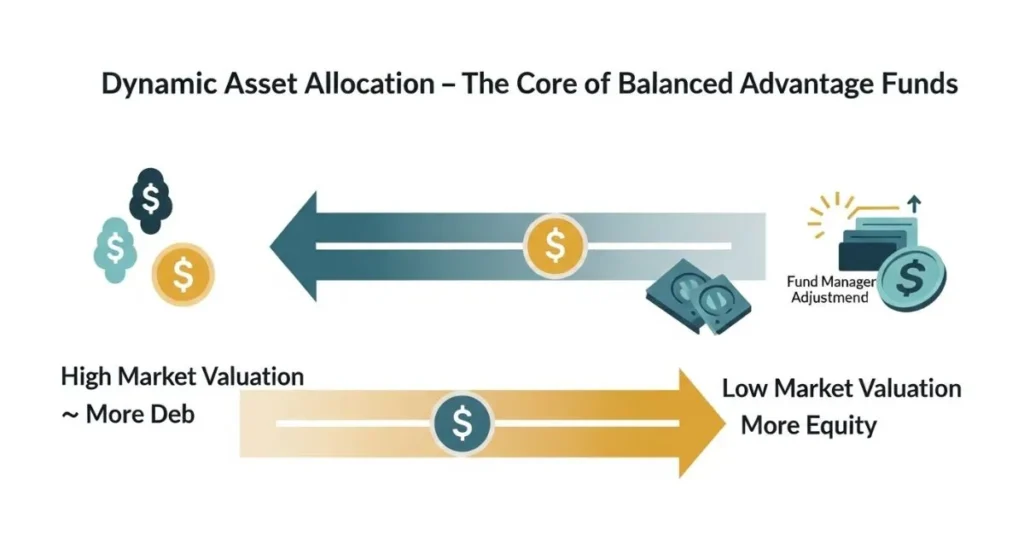

Balanced Advantage Funds are mutual funds that invest in both stocks and debt, adjusting automatically to market ups and downs. When markets look risky, they shift toward safer debt, and when opportunities arise, they grow equity exposure.

This smart flexibility helps your money grow steadily without constant worry, making Balanced Advantage Funds a great choice for investors who want balance and peace of mind in their portfolio.

“Check out the Unleash Growth: Top 10 Large Cap Mutual Funds You Should Consider in 2025 to boost your portfolio.”

Why Invest in the Best Balanced Advantage Funds in 2025?

Dynamic Allocation – Fund managers switch between equity and debt based on market conditions. When markets rise sharply, exposure to equities is reduced; when markets fall, allocation increases. This flexibility helps maintain stability.

Lower Risk, Steady Growth – These funds are designed to minimize downside risk while capturing upside potential—perfect for investors who want peace of mind with consistent returns.

Tax Efficiency – Most balanced advantage funds maintain an equity exposure above 65%, allowing them to enjoy favorable tax treatment similar to equity mutual funds.

Suitable for All Investors – Whether you are a first-time investor or someone seeking portfolio balance, the best balanced advantage funds offer a safe entry into equity markets with lower volatility.

Key Factors to Evaluate Before Choosing the Best Balanced Advantage Fund:

Performance Consistency:

Instead of looking at short-term returns, review the 3-year and 5-year CAGR. A fund that performs well across market cycles is usually more reliable.

Fund Management Strategy:

The real strength of a balanced advantage fund lies in its model — whether it’s valuation-driven or sentiment-based. Choose a fund whose philosophy matches your comfort level.

Expense Ratio:

A lower expense ratio means more returns stay in your pocket. Ideally, look for funds with expense ratios below 1%.

AUM (Assets Under Management):

Very small AUM may affect liquidity, while overly large AUM might reduce agility. Go for a balanced fund size managed by a reputed AMC.

Top 5 Best Balanced Advantage Funds in India 2025:

Below are the Direct Plan details as of October 2025, showcasing some of the most trusted and best performing balanced advantage funds in India.

1. ICICI Prudential Balanced Advantage Fund

Why Include It in the Best Balanced Advantage Funds List: India’s oldest and most trusted BAF, known for dynamic equity-debt allocation and strong downside protection.

Performance Highlights:

- 5-Year CAGR: 15.45%

- 1-Year Return: 11.2%

- AUM: ₹65,244 Cr

- Expense Ratio: 0.83%

Ideal For: Investors seeking long-term growth with market-responsive allocation. Minimum SIP: ₹100

2. HDFC Balanced Advantage Fund

Why Include It in the Best Balanced Advantage Funds List: Backed by strong AUM and consistent performance, it uses valuation models to adjust equity exposure.

Performance Highlights:

- 5-Year CAGR: 14.62%

- 1-Year Return: 10.9%

- AUM: ₹1,03,041 Cr

- Expense Ratio: 0.79%

Ideal For: Investors preferring large-scale funds with proven track record. Minimum SIP: ₹500

3. Nippon India Balanced Advantage Fund

Why Include It in the Best Balanced Advantage Funds List: Combines valuation and momentum indicators for dynamic allocation, with a strong retail SIP base.

Performance Highlights:

- 5-Year CAGR: 13.87%

- 1-Year Return: 9.8%

- AUM: ₹38,527 Cr

- Expense Ratio: 0.85%

Ideal For: Retail investors seeking flexible entry with ₹100 SIP. Minimum SIP: ₹100

4. Kotak Balanced Advantage Fund

Why Include It in the Best Balanced Advantage Funds List: Low expense ratio and conservative allocation make it ideal for cautious investors.

Performance Highlights:

- 5-Year CAGR: 13.25%

- 1-Year Return: 8.9%

- AUM: ₹22,563 Cr

- Expense Ratio: 0.68%

Ideal For: Investors focused on cost-efficiency and capital preservation. Minimum SIP: ₹500

5. Edelweiss Balanced Advantage Fund

Why Include It in the Best Balanced Advantage Funds List: A data-driven fund that adjusts equity exposure based on valuation indicators. Offers better downside protection compared to peers.

Performance Highlights:

- 5-Year CAGR: 12.95%

- 1-Year Return: 7.6%

- AUM: ₹12,944 Cr

- Expense Ratio: 0.73%

Ideal For: Investors seeking stable performance with limited risk. Minimum SIP: ₹500

| Fund Name | 5-Year CAGR | 1-Year Return | AUM (₹ Cr) | Expense Ratio | Min. SIP |

|---|---|---|---|---|---|

| ICICI Prudential Balanced Advantage | 15.45% | 11.2% | 65,244 | 0.83% | ₹100 |

| HDFC Balanced Advantage | 14.62% | 10.9% | 1,03,041 | 0.79% | ₹500 |

| Nippon India Balanced Advantage | 13.87% | 9.8% | 38,527 | 0.85% | ₹100 |

| Kotak Balanced Advantage | 13.25% | 8.9% | 22,563 | 0.68% | ₹500 |

| Edelweiss Balanced Advantage | 12.95% | 7.6% | 12,944 | 0.73% | ₹500 |

Conclusion Top 5 Best Balanced Advantage Funds:

Looking for a reliable path to wealth creation without sleepless nights? The best balanced advantage funds in India 2025 offer just that—dynamic flexibility, lower volatility, and tax efficiency all rolled into one.

Start your journey with an SIP, stay invested for the long term, and let your money grow smartly. Consult a financial advisor and make 2025 the year you achieve balanced growth and financial confidence.

Disclaimer: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Please consult your financial advisor before investing.

FAQs About Top 5 Best Balanced Advantage Funds:

1.Which BAF is best?

ICICI Prudential Balanced Advantage Fund leads with the highest 5-year CAGR (15.45%) and strong AUM. It’s ideal for cost-efficient, disciplined SIP investors seeking dynamic equity-debt balance.

2.How do I choose a balanced fund?

Choose a balanced fund with consistent long-term returns, low expense ratio, and dynamic asset allocation. Prioritize funds with strong AUM, proven downside protection, and SIP flexibility.

3.Which is the oldest balanced advantage fund in India?

ICICI Prudential Balanced Advantage Fund is the oldest BAF in India, launched in December 2006. It pioneered dynamic asset allocation strategies and remains a top performer.

4.What is the 7 5 3 1 rule in SIP?

The 7-5-3-1 rule in SIP suggests investing for 7 years in equity, 5 years in hybrid, 3 years in debt, and 1 year in liquid funds. It helps align investment horizon with risk-return expectations across asset classes.