Tata Motors stock, a leading name in India’s automotive industry, has been a focal point for investors in 2025. After a five-month consolidation, the stock shows signs of recovery. This raises the big question: Is Tata Motors stock ready for its next rally?

In this article, we’ll review the factors driving Tata Motors share price, recent performance, and whether a breakout could be near.

Understanding Tata Motors stock 5-Month Consolidation :

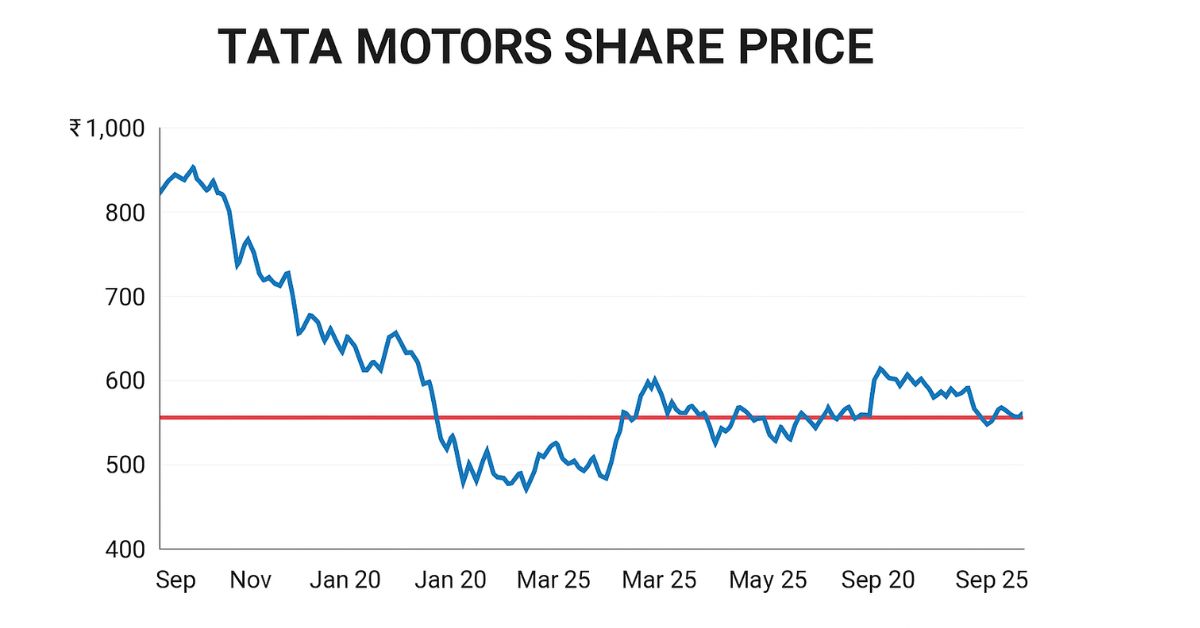

From mid-2024 to early 2025, Tata Motors share price moved sideways after a sharp fall of 38% from its peak of ₹1,179 in July 2024.

As of September 2025, it trades at ₹691.70 with a 52-week low of ₹535.75 and a high of ₹1,142.

This pause followed global headwinds like U.S. import tariffs on JLR and internal changes such as the commercial vehicle demerger. Consolidation phases often signal accumulation before the next move.

Earlier We Wrote About : Hindustan Unilever Share Price

Why Consolidation Matters ?

A consolidation phase shows the stock is stabilizing. For Tata Motors, three things stand out:

- High volumes: Over 14 million shares traded, showing strong interest.

- Support: Stock is holding near ₹690.

- Sentiment: Analysts are cautiously optimistic, some targeting ₹860.

👉 Insight: The longer the consolidation, the stronger the eventual breakout.

Key Drivers Behind Tata Motors stock Potential Rally :

1. Strategic Demerger

The commercial vehicle demerger creates a standalone entity. This unlocks value, improves profitability, and makes Tata Motors stock more attractive.

2. India-UK Free Trade Agreement (FTA)

Tariffs on JLR imports to India are cut from 100% to 10% under a quota. Since JLR drives two-thirds of revenue, this could boost sales and lift Tata Motors share price.

3. Electric Vehicle (EV) Leadership

Tata Motors dominates EVs in India. A \$1.5 billion battery gigafactory is planned, with 30% of sales targeted from EVs by 2030.

4. Debt-Free Status

In 2025, Tata Motors became debt-free. This lowers costs and frees up capital for growth.

5. Strong Track Record

Over the past 5 years, Tata Motors delivered a 627% return. Despite a recent dip, long-term growth remains strong.

Technical Analysis: Is a Breakout Imminent ?

- Moving Averages: Price is above its 25- and 50-day averages. Support sits near ₹678.

- Resistance: ₹722-742 is a key level. A breakout here may spark a rally.

- Targets: Analysts see near-term ₹704–₹718 and ₹800 by December 2025. Longer term, ₹1,100+ is possible.

👉 Insight: The weekly chart shows a W-pattern, a bullish signal. If confirmed with volumes, Tata Motors share price could climb back to ₹900 levels.

View Charts Here : On Tradingview

Risks to Watch :

- Trade tariffs: JLR exports remain vulnerable to U.S. policy changes.

- EV competition: JSW MG and others are gaining market share.

- Margins: EPS fell 8.6% YoY, showing profitability pressure.

Analyst Outlook On Tata Motors Stock :

- Short term: Target ₹860 with stop-loss at ₹700.

- Long term: Forecasts of ₹1,200–₹1,500 by 2027.

- Brokerages: Kotak is cautious, while Nomura is positive on EV growth.

Should You Invest Tata Motor Stock ?

- Traders: Watch for breakout above ₹770–₹780 before entering.

- Investors: Consolidation levels may be good for accumulation.

- Caution: Monitor tariffs and EV competition closely.

👉 Insight: With a 3–5 year view, Tata Motors stock could still be a multi-bagger if its EV and JLR strategies deliver.

Conclusion :

After five months of consolidation, Tata Motors stock looks ready for its next move. The W-pattern, restructuring, and EV leadership support a bullish case.

While risks remain, the overall outlook is positive. Investors should balance opportunity with risk and plan their entries carefully.

✅ Disclaimer: Investing in stocks carries risks. Past performance is not a guarantee of future results. Always do your own research or consult a financial advisor.