Ever feel like mutual fund statements are speaking a different language? You’re not alone. But there’s one term you can’t afford to ignore: CAGR, or Compound Annual Growth Rate. It might sound like financial term, but trust me, it’s the secret sauce to understanding your investment story.

Let me paint a picture. Two friends, Riya and Arjun, both invest ₹1 lakh. Riya’s money grows steadily, while Arjun’s portfolio is a rollercoaster of highs and lows. Who truly came out ahead? The answer isn’t in the drama, but in a simple concept: understanding CAGR in mutual funds.

What is CAGR and Why Is It Important in Mutual Funds?

So, what exactly is this magic number? In simple terms, the CAGR in mutual funds is your investment’s average annual growth rate, assuming it grew at a steady pace. It smooths out the market’s wild rides to give you one clean, understandable figure.

Imagine you put ₹1 lakh into a fund, and five years later, it’s worth ₹2 lakh. That’s a 100% total return! But what was your average yearly gain? The CAGR in mutual funds tells you it’s about 14.87%. It cuts through the noise of volatility and shows you the true, long-term speed of your wealth creation journey.

Earlier we wrote about: How to Pick the Best Mutual Funds for SIP

How to Calculate CAGR? A Step-by-Step Guide

Ready for a little math? Don’t worry, it’s painless. The formula is:

CAGR = (Ending Value / Beginning Value)^(1 / Number of Years) – 1

Let’s make it real. You invest ₹1 lakh, and in 3 years, it becomes ₹1.4 lakh.

Your calculation would be:

CAGR = (1,40,000 / 1,00,000)^(1/3) – 1

That gives you an average annual return of 11.87%.

Now, breathe easy—you don’t need to do this manually. Every fund fact sheet and app calculates it for you. Knowing how it works just helps you read the story behind the number.

The Role of CAGR in Evaluating Mutual Fund Performance:

Think of the CAGR in mutual funds as your performance compass. When you’re comparing two funds, it points you in the right direction. A fund with a 12% CAGR in mutual funds over five years has generally done better than one with 9% (assuming similar risk).

But here’s a word of caution: don’t just chase the highest number. A sky-high CAGR in mutual funds can sometimes mean sky-high risk. Always peek under the hood—look at the fund’s consistency, the manager’s experience, and the market conditions that fueled those returns.

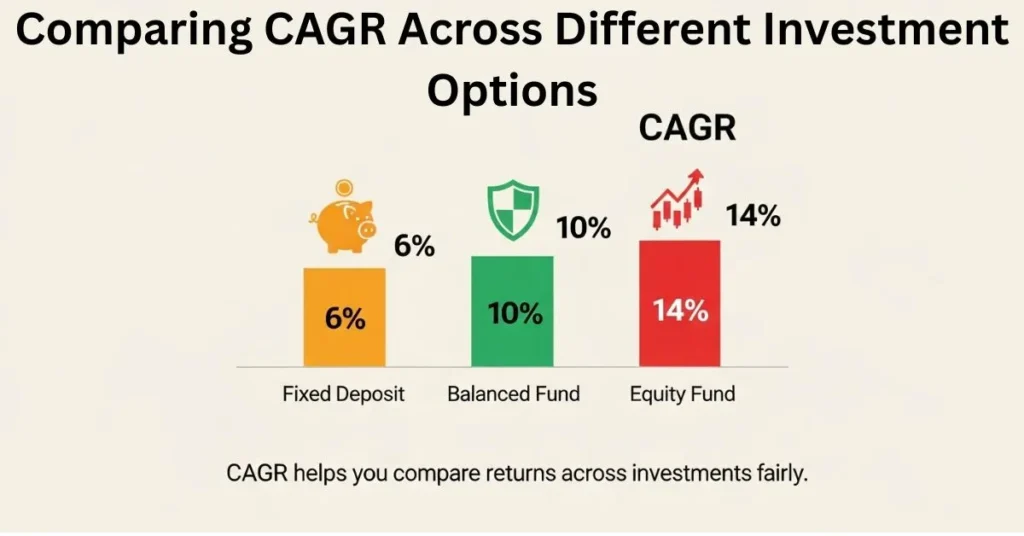

Comparing CAGR Across Different Investment Options:

This is where CAGR in mutual funds truly shines as a comparison tool. It lets you stack different investments side-by-side, like:

- A Fixed Deposit with a 6% CAGR.

- A Balanced Mutual Fund with a 10% CAGR in mutual funds.

- An Aggressive Equity Fund with a 14% CAGR in mutual funds.

While that higher number is tempting, remember the context. Mutual funds carry market risk, while FDs offer safety. Use the CAGR in mutual funds to compare apples to apples, not apples to oranges.

Why CAGR Gives a Clearer Picture?

New investors often get excited by total returns: “My money doubled!” But that doesn’t tell you how it happened. Did it shoot up in one year and stagnate for four? The CAGR in mutual funds breaks it down into an annualized rate. It’s like knowing your car’s average speed on a long road trip, rather than just remembering the moments you were speeding or stuck in traffic.

Conclusion:

Getting comfortable with the CAGR in mutual funds is like learning the native language of investing. It transforms you from a passive observer into an informed wealth builder. It helps you compare, plan, and invest with clarity.

So, the next time someone asks how your investments are doing, don’t just talk about the total gain. Mention your CAGR. You’ll instantly sound like a pro who understands what true, sustainable growth is all about.

💹 Click here to read Part 2: Using CAGR in Mutual Funds Like a Pro

Disclaimer:

Mutual fund investments are subject to market risks. Past performance or CAGR in mutual funds does not guarantee future returns. Please consult a financial advisor before investing.

FAQs About CAGR In Mutual Funds:

1.How do you calculate CAGR?

CAGR = ((\text{Ending Value} / \text{Beginning Value})^{1/n} – 1), where n is the number of years.

It shows the smoothed annual growth rate of an investment over time.

2.Is 12% CAGR good?

Yes, 12% CAGR is considered strong—well above inflation and typical fixed-income returns.

It indicates solid long-term growth, especially for equity or mutual fund investments.

3.What does a 10% CAGR mean?

A 10% CAGR means the investment grew at an average rate of 10% per year over the period.

It reflects consistent compounding growth, not just simple annual returns.

4.What is a 3-year CAGR?

A 3-year CAGR shows the average annual growth rate of an investment over the past 3 years.

It smooths out short-term volatility to reflect consistent compounding returns.