So, you’ve got a handle on what CAGR means. That’s awesome—you’re already ahead of the curve! But knowing what it is and knowing how to use it are two different things. Think of CAGR in mutual funds as a powerful tool in your investor toolkit. Let’s talk about how to actually use it to build wealth smarter, not harder.

Ready to turn that knowledge into real-world power? Let’s go.

👉 New here? Check out Part 1: Understand CAGR in Mutual Funds Like a Pro before diving into this one!

Understanding the Impact of Time Horizon on CAGR:

Here’s a classic investor trap: comparing CAGRs without looking at the timeline.

Picture this. One fund boasts a 20% CAGR in mutual funds over one year. Another shows a 12% CAGR in mutual funds over five years. Which one would you pick?

Your first instinct might be the 20% fund. Who wouldn’t? But that one-year star might have just caught a lucky market wave. The five-year fund, with its steady 12%, has proven it can perform through ups and downs. This is the real power of CAGR in mutual funds—it reveals long-term stamina over short-term luck. For big goals like your child’s education or your retirement, a consistent, long-term CAGR in mutual funds is what truly counts.

Common Misconceptions About CAGR in Mutual Funds:

Let’s clear up a few common confusions, shall we?

First, a 12% CAGR in mutual funds doesn’t mean your fund grew by exactly 12% each year. It’s an average. In reality, one year it could have jumped 25%, the next it might have dropped 5%, but it all smoothed out to that 12% average.

Second, a sky-high CAGR isn’t always a green light. It could be the result of a raging bull market or a risky bet that paid off. A slightly lower, but more consistent CAGR in mutual funds often points to a resilient, well-managed fund.

And please, never compare the CAGR of a conservative debt fund with a volatile equity fund. It’s like comparing a scooter to a sports car—they’re built for completely different journeys!

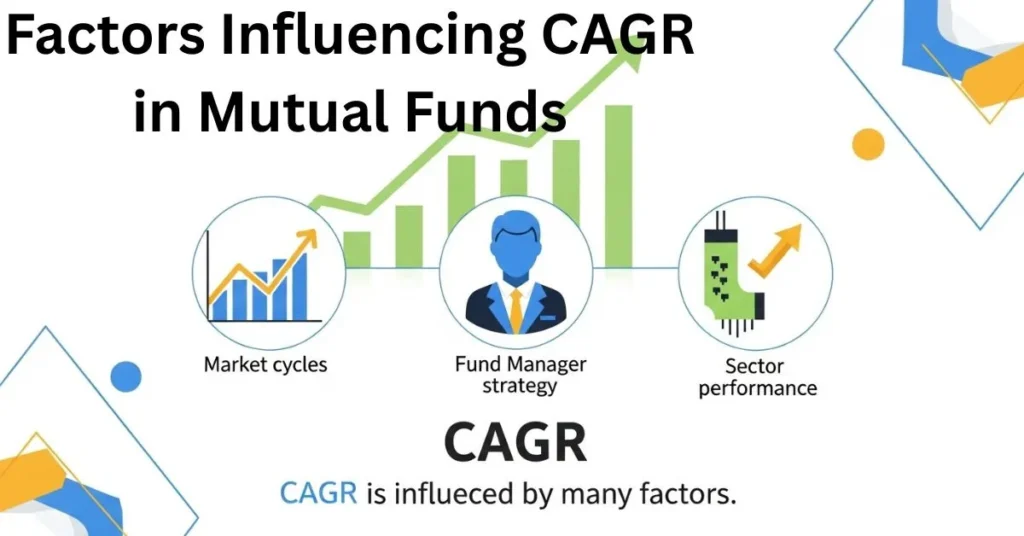

Factors Influencing CAGR in Mutual Funds:

What actually creates that CAGR number you see? It’s a mix of ingredients: market mood, the fund manager’s skill, which sectors the fund invests in, and the overall economy.

A tech fund might show a stunning CAGR in mutual funds during a tech boom. But that doesn’t mean it’ll repeat that performance when the cycle turns.

This is why you need to look beyond the headline number. Check the fund’s consistency. How much does it bounce around? A steady fund with a 12% CAGR in mutual funds can be far more rewarding than a rollercoaster fund that hits 15% but gives you sleepless nights.

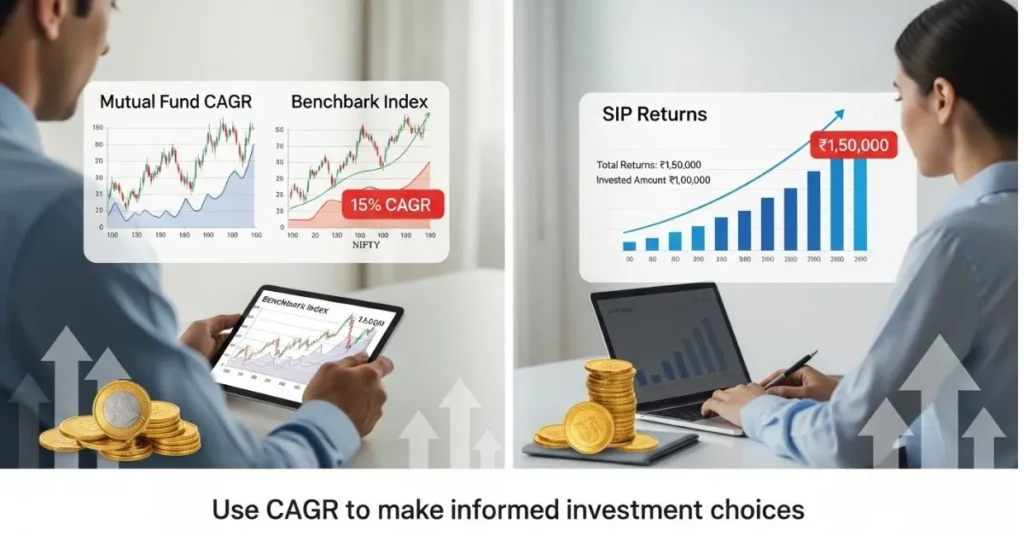

How to Use CAGR for Smart Investment Decisions?

Okay, this is the practical part. How do you make CAGR in mutual funds work for you?

Start by playing the comparison game. Stack your fund’s CAGR against a relevant benchmark, like the Nifty 50. If your fund consistently beats that benchmark over 5 or 10 years, you’re likely onto a winner.

You can also use it for your SIPs. While the calculation gets trickier with monthly investments, an approximate CAGR in mutual funds still helps you see how your regular money is compounding over time.

Perhaps most importantly, use CAGR to set realistic goals. If the long-term history of equity markets points to a 12-14% CAGR in mutual funds, expecting 25% yearly is a recipe for disappointment. This number keeps your feet on the ground and your strategy on track.

Real-Life Examples of CAGR in Mutual Funds:

Let’s bring this to life with a story.

Meet Meera. In 2015, she invested ₹2 lakh. By 2025, her level-headed investment grew to ₹6.2 lakh. That’s a CAGR of about 11.9%. Her money nearly tripled in a decade through steady, solid growth.

Now, meet Raj. He also invested ₹2 lakh in 2015, but in a more aggressive fund. His investment soared to ₹8 lakh by 2025—a 14.9% CAGR.

Who did better? It’s not that simple. Meera valued stability, Raj was okay with higher risk for a higher reward. The CAGR in mutual funds didn’t choose a winner; it just gave each of them a clear, honest measure of their chosen path.

CAGR Is Your Investment Reality Check:

In a world of financial hype and scary headlines, the CAGR in mutual funds is your calm, rational friend. It cuts through the noise and tells you the unvarnished truth about your money’s performance.

It empowers you to compare apples to apples, judge a fund’s true character, and plan your future with confidence. When you start thinking in CAGRs, you stop worrying about daily market drama and start focusing on the timeless wealth-builders: patience and consistency.

Conclusion:

Remember, CAGR isn’t just a percentage on a screen. It’s the story of your financial journey—a tale of how your patience and your money compounded together over time.

So, the next time you open your portfolio, don’t just glance at the current value. Seek out the CAGR. Understand its story. Let it guide your next move. Because when you know how to read your growth, you truly know how to build your wealth.

Disclaimer:

Mutual fund investments are subject to market risks. CAGR doesn’t guarantee future returns. Invest wisely.

FAQs About CAGR In Mutual Funds:

1.Can the CAGR formula be used for investments?

Yes, the CAGR (Compound Annual Growth Rate) formula is widely used to measure investment growth over time. It helps compare returns across funds by smoothing out volatility.

2.What are the factors affecting CAGR?

CAGR is influenced by the investment’s starting value, ending value, and the time period held. Market volatility, reinvestment strategy, and compounding frequency also impact the final growth rate.

3.How does CAGR work in mutual funds?

CAGR in mutual funds shows the average annual growth rate of your investment over a specific period. It smooths out short-term volatility to reflect long-term performance.