Ever wondered how some people seem to grow their wealth quietly and steadily — without spending hours tracking the stock market? Chances are, mutual funds play a big part in their strategy.

They’re one of the simplest yet smartest ways to invest — even if you’re not a finance expert. In this guide, we’ll break down how mutual funds work, what makes them so popular, and how you can use them to build long-term wealth.

Understanding Mutual Funds: An Overview

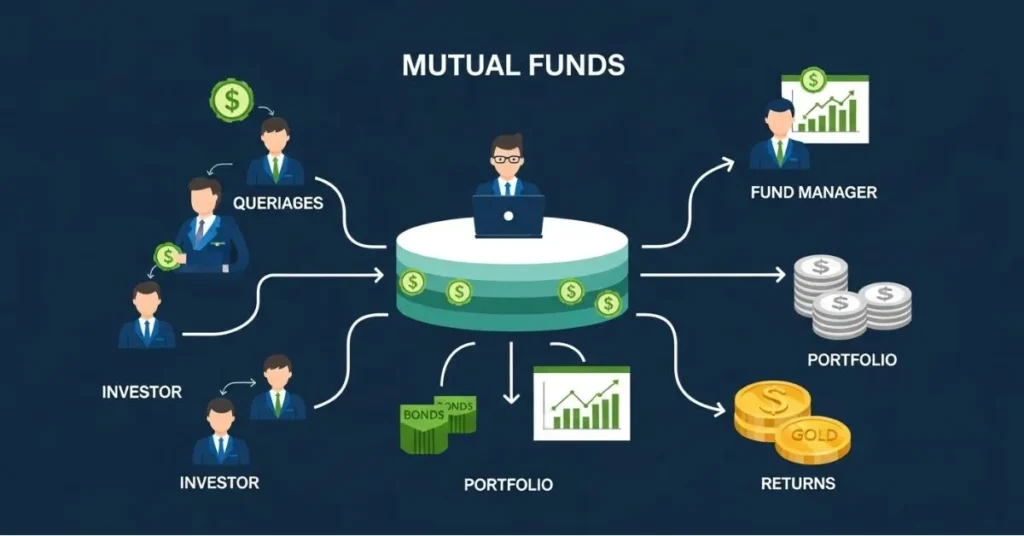

Let’s start with the basics. A mutual fund is like a financial pot where many investors put their money together. This pooled money is then invested in stocks, bonds, or other securities by a professional fund manager.

Think of it like joining a group trip — everyone contributes, and an expert driver (the fund manager) takes you to the destination (financial growth).

For a deeper understanding of mutual fund returns, don’t miss our earlier guide on CAGR in Mutual Funds.

The Different Types of Mutual Funds

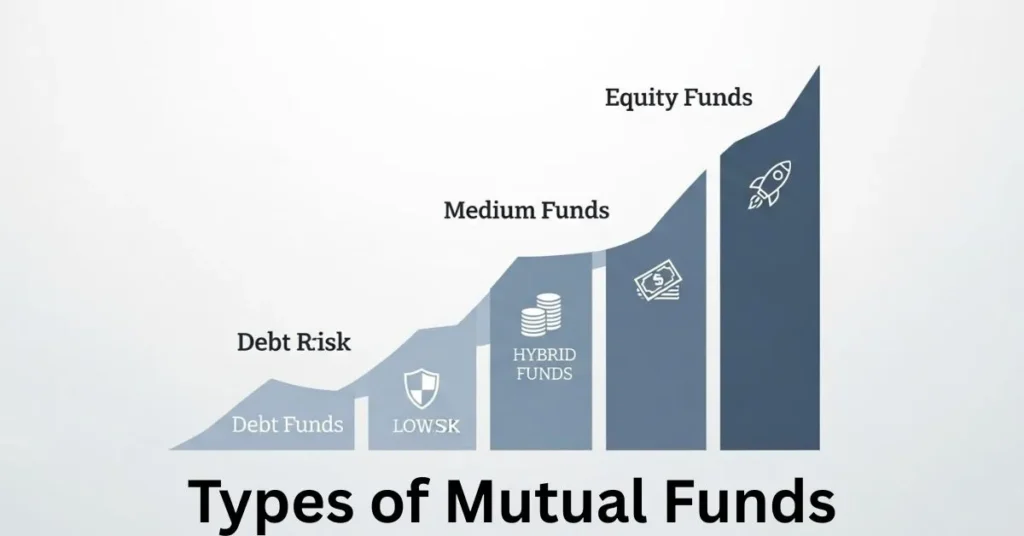

Not all mutual funds are the same. Depending on your goals and risk appetite, you can choose from several types:

- Equity Funds invest mainly in stocks and aim for higher returns over the long term.

- Debt Funds focus on fixed-income instruments like bonds and are ideal for conservative investors.

- Hybrid Funds blend both equity and debt to balance growth and stability.

So, whether you’re a risk-taker or prefer safety first, there’s a mutual fund that fits your personality — that’s the magic of how mutual funds work for everyone.

How Mutual Funds Work: The Mechanics Explained

When you invest in a mutual fund, your money is combined with other investors’ contributions. The total pool is then managed by a fund manager, who decides where to invest — which stocks to buy, when to sell, and how to rebalance the portfolio.

As the investments grow in value, you earn profits either through:

- Dividends or interest income, or

- Capital appreciation (when the fund’s investments rise in value).

You can track your investment through the Net Asset Value (NAV), which represents the per-unit price of the fund. When the NAV increases, so does your wealth. That’s essentially how mutual funds work — your money grows with the market’s performance, without you needing to monitor every stock.

Key Benefits of Investing in Mutual Funds

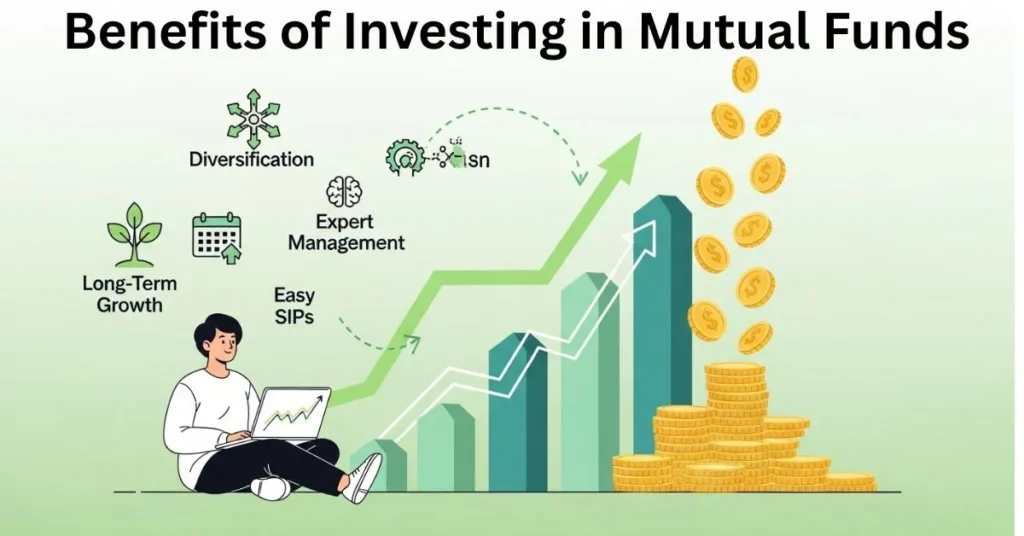

One of the best parts about how mutual funds work is the wide range of benefits they offer:

First, they make diversification effortless — instead of betting on one company, your investment spreads across many.

Second, they’re professionally managed, meaning your money is handled by experts who understand the markets better than most individuals.

Third, they’re accessible and flexible — you can start with as little as ₹500 through SIPs (Systematic Investment Plans).

Risks Associated with Mutual Funds

Of course, no investment is risk-free. The value of mutual funds fluctuates with the market. When the market dips, your returns might too.

But here’s the key — staying invested for the long term smooths out short-term volatility. That’s why understanding how mutual funds work helps you stay patient during ups and downs.

The right fund choice and a long-term mindset can make all the difference.

How to Choose the Right Mutual Fund for You

Choosing the right mutual fund depends on your financial goals, time horizon, and comfort with risk.

If you’re saving for long-term goals like retirement, equity funds might suit you best. For short-term needs, debt or hybrid funds could be better.

Before investing, always check the fund’s past performance, expense ratio, and consistency. And most importantly, align your investments with your personal goals — not someone else’s.

That’s the smart investor’s secret behind how mutual funds work for real success.

The Role of Mutual Fund Managers

A mutual fund manager is like the captain of your investment ship. Their job is to research markets, identify opportunities, and steer the fund toward growth.

They analyze data, study trends, and make timely decisions — so you don’t have to. Their expertise is what makes mutual funds efficient, structured, and goal-oriented.

When you understand how mutual funds work, you realize that a skilled fund manager can be your biggest asset.

Tax Implications of Mutual Fund Investments

Taxes depend on the type of mutual fund and how long you stay invested.

For equity funds, short-term gains (less than one year) are taxed at 15%, while long-term gains (beyond one year) enjoy a lower rate of 10% after ₹1 lakh.

Debt funds, on the other hand, are taxed according to your income slab.

Common Myths About Mutual Funds Debunked

Myth 1: Mutual funds are only for the rich.

Truth: You can start small with SIPs.

Myth 2: Mutual funds guarantee returns.

Truth: They don’t — returns depend on market performance.

Myth 3: You need to constantly track your investments.

Truth: The fund manager does the hard work for you.

Once you know how mutual funds work, these myths lose their power.

Conclusion: Is Investing in Mutual Funds Right for You?

If you want your money to work harder without constantly worrying about the market, mutual funds are a great choice.They blend convenience, expert management, and long-term growth — all in one package.

Understanding how mutual funds work helps you invest confidently and stay focused on your financial goals.So, whether you’re just starting your investment journey or looking to diversify, mutual funds can help you unlock your wealth potential — one SIP at a time.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Please consult a qualified advisor before making investment decisions

FAQs About How Mutual Funds Works:

1.How should a beginner invest in mutual funds?

Start with SIPs in diversified equity funds for long-term growth and lower entry risk.

Use direct plans via trusted platforms to avoid commissions and maximize returns.

2.How do I make money from mutual funds?

You earn through capital appreciation as fund value grows and dividends if the fund distributes profits.

Stay invested long-term and choose funds aligned with your risk-return goals for optimal gains.

3.What is the 7 5 3 1 rule in SIP?

The 7-5-3-1 rule suggests staying invested for 7 years in equity, 5 in balanced, 3 in debt, and 1 in liquid funds.

It helps align fund choice with investment horizon and risk tolerance.

4.What are the 4 types of mutual funds?

The four main types are equity, debt, hybrid, and money market funds.

Each suits different risk levels and investment horizons.