Are you searching for the best index funds in India 2025 to build long-term wealth with minimal effort? Index funds are the simplest, most cost-effective way to participate in the stock market — offering steady growth without worrying about market timing or fund manager performance.

In this article, we’ll explore the Top 5 Best Index Funds in India 2025, analyze their returns, and understand why these are the best performing index funds in India for investors who prefer smart, stress-free investing.

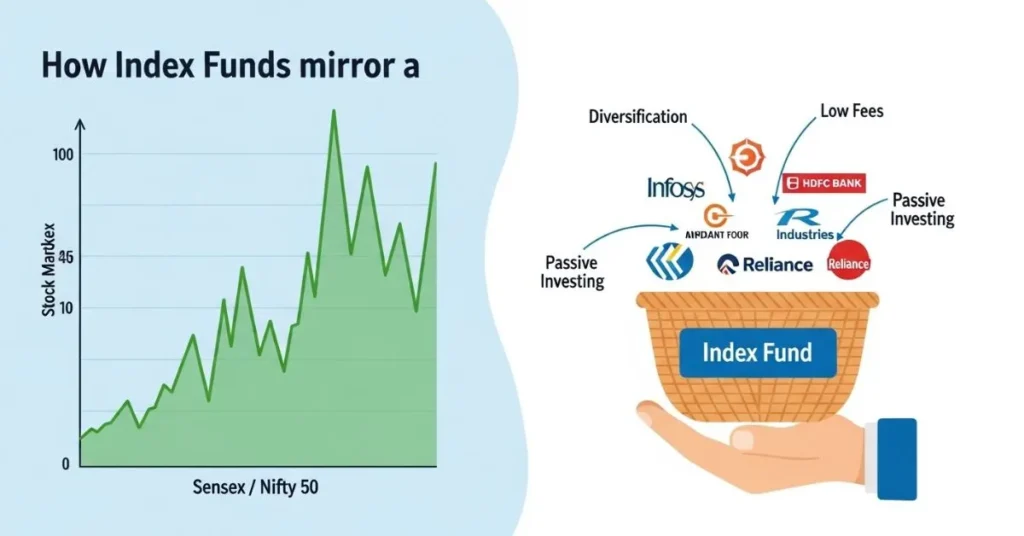

What Are Index Funds?

Index funds are mutual funds that mirror the performance of a stock market index like the Nifty 50 or Sensex. They invest in the same companies and in the same proportion as the index. So, if the Nifty 50 rises by 10%, your fund grows roughly by 10% too (minus small expenses).

The beauty of index funds lies in their simplicity and low cost. There’s no fund manager trying to beat the market — instead, the fund automatically tracks the market’s movement. This makes index funds a perfect choice for investors seeking long-term, predictable growth.

Looking for more smart investment options? Check out our detailed guide on the Top 5 Best Balanced Advantage Funds in India 2025 for SIP & Long-Term Growth

Why Invest in the Best Index Funds in India 2025?

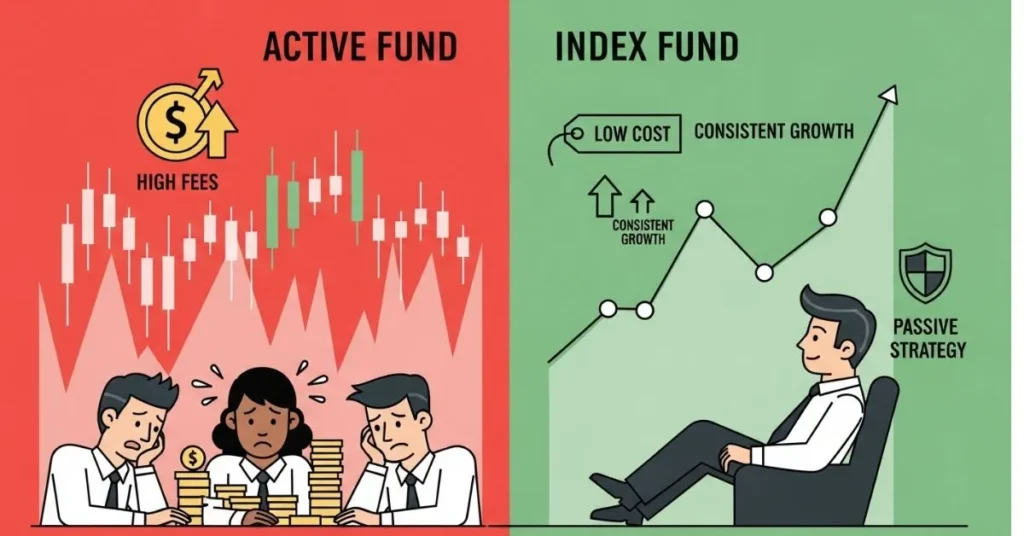

Low Costs, High Transparency:

Index funds have some of the lowest expense ratios among all mutual funds. Less cost means more of your money stays invested — helping you earn higher returns over time.

Market-Linked Growth:

By investing in the best index funds in India, you own a slice of India’s top companies. As the economy grows, your investments grow too.

Ideal for Beginners:

You don’t need to track the market daily. Just invest through SIPs and let the power of compounding do its job.

Proven Long-Term Results:

Over 10–15 years, many index funds have outperformed actively managed funds, thanks to lower costs and consistent exposure to top-performing stocks.

Key Factors to Evaluate Before Choosing an Index Fund:

1. Tracking Error:

This shows how closely the fund follows its benchmark index. The lower the tracking error, the better.

2. Expense Ratio:

A key reason index funds outperform — look for funds with expense ratios below 0.5%.

3. Fund House Reputation:

Choose AMCs with a strong record in passive fund management and reliable execution.

4. AUM (Assets Under Management):

A healthy AUM ensures liquidity and efficient management.

Top 5 Best Index Funds in India 2025:

Below are the Direct Plan details as of October 2025 — representing the best performing index funds in India based on long-term stability and returns.

1. HDFC Index Fund – Nifty 50 Plan

Why It’s Among the Best: A trusted and consistent performer tracking the Nifty 50, ideal for SIP investors.

Performance Highlights:

- 5-Year CAGR: ~14.58%

- 1-Year Return: ~11.3%

- AUM: ₹20,930 Cr

- Expense Ratio: 0.35%

Ideal For: Long-term investors seeking stability with low cost.

Minimum SIP: ₹500

2. ICICI Prudential Nifty Next 50 Index Fund

Why It’s Among the Best: Offers exposure to India’s emerging large-cap leaders beyond the top 50 stocks.

Performance Highlights:

- 5-Year CAGR: ~20.05%

- 1-Year Return: ~-8.82%

- AUM: ₹7,964 Cr

- Expense Ratio: 0.68%

Ideal For: Investors looking for higher growth with moderate volatility.

Minimum SIP: ₹1,000

3. UTI Nifty 50 Index Fund

Why It’s Among the Best: One of the oldest index funds with efficient tracking and strong long-term record.

Performance Highlights:

- 5-Year CAGR: ~13.03%

- 1-Year Return: ~10.8%

- AUM: ₹24,336 Cr

- Expense Ratio: 0.17%

Ideal For: Conservative investors seeking reliable Nifty exposure.

Minimum SIP: ₹500

4. Nippon India Nifty 50 Index Fund

Why It’s Among the Best: Popular among retail investors due to low cost and easy accessibility.

Performance Highlights:

- 5-Year CAGR: ~12.96%

- 1-Year Return: ~10.4%

- AUM: ₹2,679 Cr

- Expense Ratio: 0.07%

Ideal For: SIP investors who want steady, no-fuss returns.

Minimum SIP: ₹500

5. Motilal Oswal Nifty 500 Index Fund

Why It’s Among the Best: Offers broad market exposure across large, mid, and small caps.

Performance Highlights:

- 5-Year CAGR: ~15.91%

- 1-Year Return: ~12.2%

- AUM: ₹2,507 Cr

- Expense Ratio: 0.88%

Ideal For: Investors seeking diversification across market segments.

Minimum SIP: ₹500

| Fund Name | 5-Year CAGR | 1-Year Return | AUM (₹ Cr) | Expense Ratio | Min SIP |

|---|---|---|---|---|---|

| HDFC Index Fund – Nifty 50 | ~14.58% | ~11.3% | ₹20,930 | 0.35% | ₹500 |

| ICICI Pru Nifty Next 50 | ~20.05% | ~-8.82% | ₹7,964 | 0.68% | ₹1,000 |

| UTI Nifty 50 Index Fund | ~13.03% | ~10.8% | ₹24,336 | 0.17% | ₹500 |

| Nippon India Nifty 50 | ~12.96% | ~10.4% | ₹2,679 | 0.07% | ₹500 |

| Motilal Oswal Nifty 500 | ~15.91% | ~12.2% | ₹2,507 | 0.88% | ₹500 |

Conclusion: About Best Index Funds In India 2025:

Looking for effortless investing with consistent returns? The best index funds in India 2025 offer exactly that — low cost, steady growth, and zero stress.

By investing through SIPs in any of these top 5 index funds in India, you can build long-term wealth without constantly tracking the market. Start early, stay invested, and let compounding take care of the rest.

Make 2025 the year you invest smarter — with the best performing index funds in India leading your way to financial freedom.

Disclaimer: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Consult your financial advisor before making any investment decisions.

FAQs About About Best Index Funds In India 2025:

1.Which index fund is best for 2025?

ICICI Prudential Nifty Next 50 Index Fund leads 2025 with ~20.05% 5Y CAGR, offering high growth from emerging large caps.

Best suited for aggressive investors seeking long-term alpha beyond Nifty 50.

2.What is the 7 5 3 1 rule in SIP?

The 7-5-3-1 rule in SIP sets realistic return expectations: 7% from debt funds, 5% from hybrid, 3% from savings, and 1% from idle cash.

It guides investors to choose long-term instruments for better wealth creation.

3.Which midcap index fund is best in India?

Motilal Oswal Nifty Midcap 150 Index Fund is the top midcap index fund in India for 2025 with ~21.24% 3Y annualized returns. Ideal for investors seeking high-growth potential from quality midcap companies.