So, you’re investing in mutual funds to build your future. That’s awesome! But have you ever stopped to think about what it actually costs to own them?

It’s easy to miss, but there’s a little number in the fine print that can quietly nibble away at your returns. Let’s get cozy and talk about what is expense ratio in mutual funds. Once you understand it, you’ll be a smarter investor.

What is Expense Ratio in mutual funds?

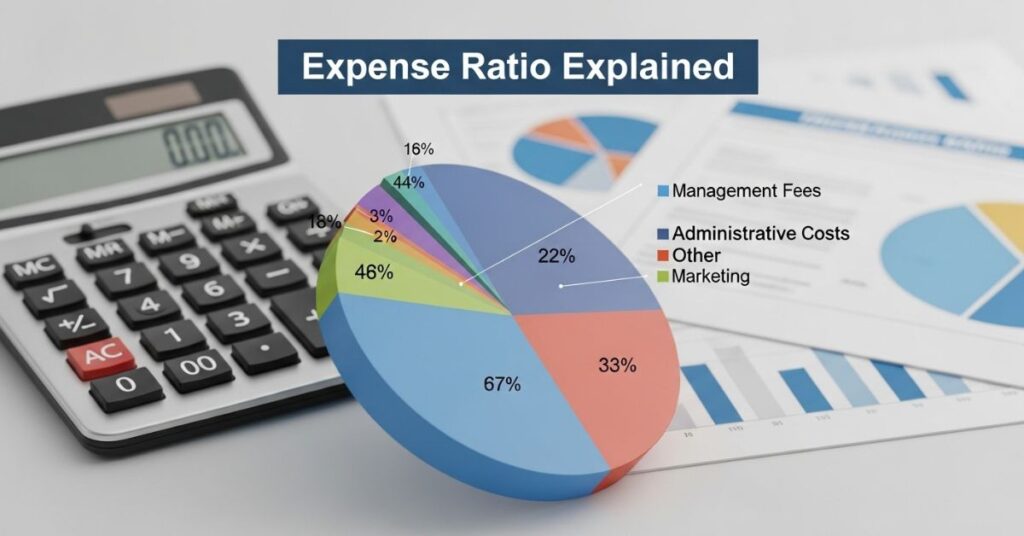

An expense ratio is the annual fee that mutual funds charge their investors to cover operating costs, such as management fees, administrative expenses, and marketing costs. This fee is expressed as a percentage of the fund’s average assets under management (AUM). For example, if a fund has an expense ratio of 1%, you would pay ₹1000 annually for every ₹1,00,000 invested in that fund.

Also check out our article: Don’t Invest Blindly! Learn How Mutual Funds Work Before You Start

Why Expense Ratios Matter for Investors?

You might think, “It’s just 1%!” But over time, that small fee has a massive impact on your money’s growth potential.

Let’s say you have two funds that perform identically. One has a 1% expense ratio, and the other charges just 0.2%. Over 20 or 30 years, the difference in your final balance could be staggering. That’s money straight out of your pocket!

This is precisely why understanding what is expense ratio in mutual funds is so critical for your financial health.

Comparing Expense Ratios Across Mutual Funds:

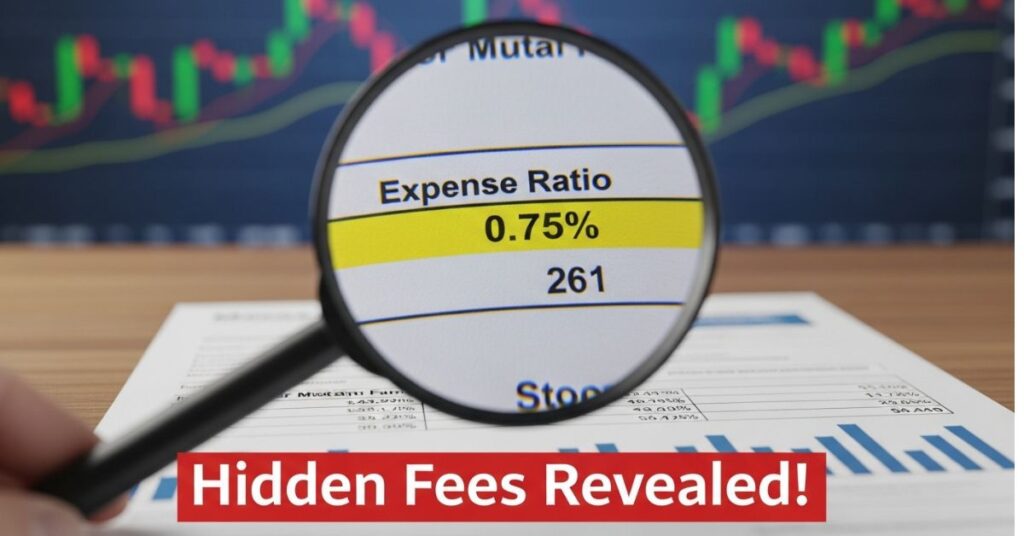

Not all funds cost the same. When you’re shopping, comparing expense ratios is like comparing price tags.

Generally, index funds and ETFs have much lower fees. Actively managed funds, where a team is constantly picking stocks, are more expensive.

For example, the average actively managed fund might charge 0.5% to 0.75%, while a passive index fund might only be 0.12%.

Knowing what is expense ratio in mutual funds helps you see which fund is giving you more bang for your buck.

The Relationship Between Expense Ratios and Fund Performance:

Here’s a key insight: there’s often an inverse relationship between fees and performance.

A fund with a high expense ratio has a taller mountain to climb. It has to perform that much better just to match the net returns of a cheaper fund. Often, it can’t.

Over time, the magic of compounding works in reverse on fees, too. Lower costs mean more of your money stays invested to grow. This is a huge part of what is expense ratio in mutual funds—it’s a drag on your engine.

How to Evaluate Expense Ratios When Choosing a Fund:

- Fund Type: Index funds and ETFs generally offer lower expense ratios compared to actively managed funds.

- Fund Category: Compare funds within the same asset class (e.g., large-cap equity funds) to ensure you’re making an apples-to-apples comparison.

- Performance History: While past performance isn’t indicative of future results, it’s helpful to see how a fund has performed relative to its peers after accounting for fees.

- Additional Costs: Be aware of other fees, such as sales loads or redemption fees, which can further impact your returns.

Tips for Minimizing the Impact of Expense Ratios on Your Portfolio:

- Opt for Low-Cost Funds: Choose funds with lower expense ratios to maximize your investment returns.

- Diversify Your Investments: Spread your investments across different asset classes to reduce risk.

- Monitor Your Investments: Regularly review your portfolio to ensure it aligns with your financial goals and that the funds continue to offer competitive returns after fees.

- Consider Direct Plans: In India, direct plans of mutual funds have lower expense ratios compared to regular plans, as they don’t involve intermediaries.

Conclusion: Making Informed Investment Decisions

See? Understanding what is expense ratio in mutual funds isn’t just financial term—it’s one of the most practical steps you can take to protect your wealth.

By choosing low-cost funds and keeping a watchful eye on fees, you ensure your hard-earned money is working for you, not just paying for the picnic.

Now that you know what is expense ratio in mutual funds, go log into your account and take a look. You’ve got this

Disclaimer: The information provided is for educational purposes only and does not constitute financial advice. Please consult a certified financial advisor before making any investment decisions.

FAQs About what is expense ratio in mutual funds:

1.What is a good expense ratio?

A good expense ratio is typically below 1% for actively managed funds and under 0.5% for index funds. Lower ratios mean more of your money stays invested, boosting long-term returns.

2.What does a 1% expense ratio mean?

A 1% expense ratio means the fund charges ₹1 annually for every ₹100 invested. It covers management fees and operating costs, reducing your net returns.

3.What is a good PE ratio?

A good P/E ratio typically ranges from 15 to 25 for stable companies, indicating fair valuation. Lower ratios may suggest undervaluation, while higher ones imply growth expectations.

4.What expense ratio is too high?

An expense ratio above 2% is generally considered too high, especially for equity funds. It can significantly erode long-term returns and signal inefficient fund management.