Ever notice how some people seem to build wealth almost effortlessly? Their secret often lies in finding the best mutual funds for SIP and sticking with them.

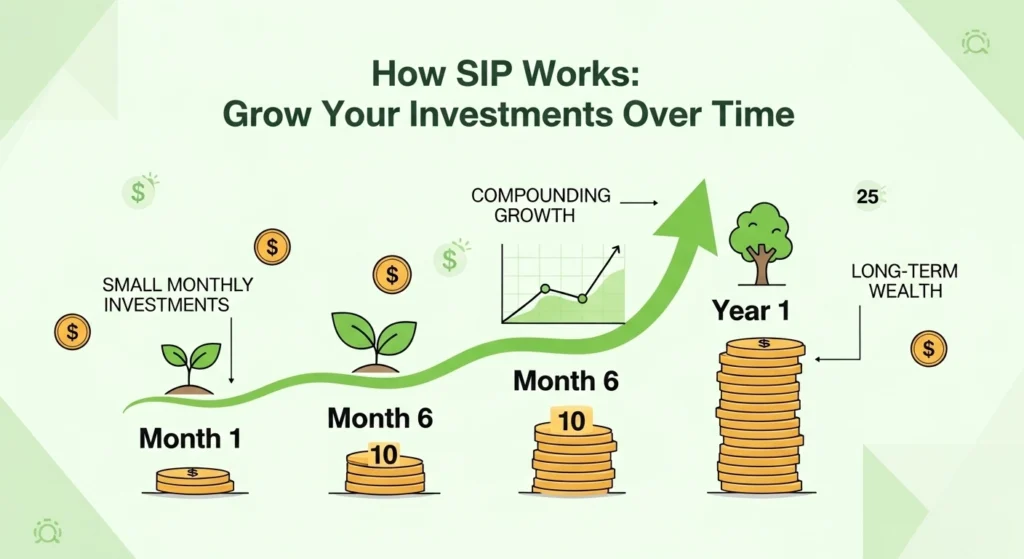

A Systematic Investment Plan (SIP) lets you invest in mutual funds regularly, turning “I should invest” into “I am investing.” You skip the stress of timing the market and just focus on being consistent.

But let’s get real. The magic doesn’t happen by just picking any fund. The real growth comes from choosing the best mutual funds for SIP. So, how do you find them? Let’s figure it out together.

🌱 Understanding SIPs and Why They Work:

Think of a SIP like a monthly coffee date with your future self. You invest a fixed amount, rain or shine.

The beauty is in a concept called “rupee cost averaging.” When prices are low, your fixed investment buys more units. When they’re high, you buy fewer. Over time, this smooths out your average cost. It’s a slow-and-steady win that builds wealth quietly.

But to make this strategy sing, you need the right partner. That’s why hunting for the best mutual funds for SIP is your most important first step.

Earlier we wrote about: Top 10 Best Thematic Mutual Funds in 2025

💡 Step 1: Define Your Financial Goals:

Before we dive into fund facts, let’s talk about you. Why are you investing?

- Is it for a down payment in 10 years?

- Your child’s college fund?

- A dream retirement?

Your goal decides the race, and the fund is your vehicle. For a long, bumpy road (5+ years), you need a sturdy off-road vehicle like an equity fund. For a smoother, shorter trip (1-3 years), a safer sedan like a debt fund is better.

The best mutual funds for SIP are the ones that line up perfectly with your destination and your comfort with bumps along the way.

📊 Step 2: Look at Fund Performance (But Not Just Returns!):

It’s so tempting to grab the fund with last year’s highest returns. Don’t do it! That’s like picking a marathon runner based on a single sprint.

Instead, look for consistency. Check how the fund has performed over 3 to 5 years compared to its peers and its benchmark. Look at metrics like the Sharpe Ratio (which measures risk-adjusted returns) and rolling returns.

The best mutual funds for SIP aren’t the flashy stars; they’re the reliable workhorses that deliver steady growth through market cycles.

🧩 Step 3: Evaluate the Fund Manager:

A mutual fund is only as good as its captain—the fund manager. You’re trusting this person with your hard-earned money!

Do a quick background check. How long have they been steering the ship? What’s their track record? Also, check the reputation of the asset management company (AMC). A trustworthy AMC with a long history is a great sign.

When identifying the best mutual funds for SIP, the team behind the fund is a clue you can’t afford to ignore.

💰 Step 4: Don’t Let Fees Sneak Up on You:

Fees matter more than you think. A high expense ratio quietly nibbles away at your returns year after year.

For a SIP investor, a difference of even 0.5% can add up to a significant amount over 10 or 15 years. The best mutual funds for SIP typically have competitive, transparent fees.

Also, peek at the exit load (a fee for selling too soon), though with SIPs, you should be in it for the long haul.

🧭 Step 5: Diversify Wisely:

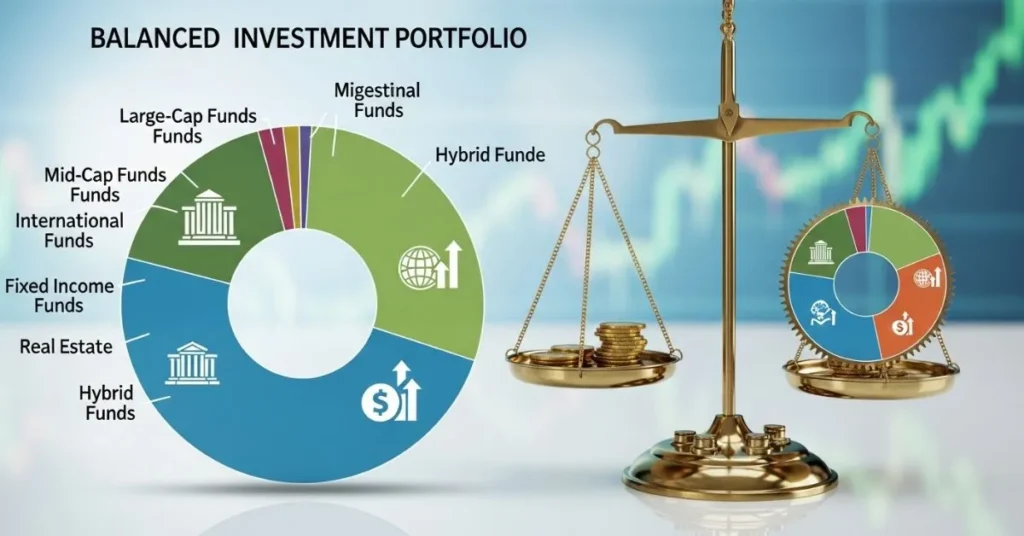

Putting everything into one “amazing” fund is risky. The smarter move? Diversify.

Spread your SIPs across different types of funds. Maybe pair a stable large-cap fund with a growth-oriented mid-cap fund. This way, if one part of the market dips, the others can help balance it out.

The true best mutual funds for SIP are the ones that, when combined, create a resilient, all-weather portfolio for you.

🌟 Step 6: Review and Rebalance:

Your work isn’t done after you set up your SIPs. Life changes, and so do markets.

Once a year, grab a coffee and review your portfolio. Is a fund consistently lagging behind its category for 2-3 years? It might be time for a change. Stay consistent with your payments, but be flexible with your strategy.

✅ Conclusion:

Remember, a SIP isn’t a get-rich-quick scheme. It’s a journey to build wealth month by month, with discipline. By taking the time to find the best mutual funds for SIP, you’re not just picking investments—you’re building a system that works for you, not against you.

Start small. Stay steady. Check in now and then. Your future self is already cheering you on.

Disclaimer: Investments in mutual funds are subject to market risks. Please do your own research or consult a financial advisor before investing.

FAQs About How to Pick the Best Mutual Funds for SIP:

1.How to choose the best SIP mutual funds?

Pick funds with consistent 3–5 year performance, low expense ratio, and strong fund manager track record. Match fund category (large-cap, flexi-cap, etc.) to your risk profile and investment horizon.

2.Which SIP is best for beginners?

Motilal Oswal Midcap Fund and Nippon India Small Cap Fund offer strong returns and suit long-term goals. Start with ₹500 monthly and stay invested for 5+ years to benefit from compounding.

3.What is the 3-5-10 rule for mutual funds?

The 3-5-10 rule checks a fund’s performance over 3, 5, and 10 years to assess consistency and long-term returns. Choose funds that outperform benchmarks across all three periods for reliability.

4.Is Groww SIP safe to use?

Yes, Groww SIP is safe—it’s regulated by SEBI and uses secure payment gateways. Your investments go directly into AMFI-registered mutual funds, not held by the platform.