Securing Your Family’s Future: Finding the Best Term Plan for 1 Crore

Life is wonderfully unpredictable, but your family’s financial security shouldn’t be. If the unexpected were to happen, could your loved ones continue living in the same home, afford your children’s education, and live with dignity? This is the profound peace of mind that a robust term insurance plan provides. For a growing number of families, finding the best term plan for 1 crore is the cornerstone of a solid financial plan, offering a level of coverage that truly safeguards their future.

Think of term insurance as a simple, powerful promise. You pay an affordable premium, and in return, your family’s future is secured with a strong financial safety net. It’s this straightforward nature that makes it so accessible. For anyone with people counting on them, choosing the best term plan for 1 crore is a profound act of love—a way to ensure their dreams are protected, no matter what.

Table of Contents

Understanding Term Insurance: What You Need to Know

At its heart, term insurance is a promise of protection. Its main goal is to replace your income for your family in your absence. The reason it’s so highly recommended is its cost-effectiveness. Because it offers pure risk cover without any maturity benefits, the premiums are significantly lower than other insurance products. This allows you to opt for a high cover, like ₹1 crore, without straining your finances.

You can usually choose a policy term that aligns with your major financial responsibilities—say, until your retirement age or until your home loan is fully repaid. Getting this foundational understanding right is the first step towards choosing your best term plan.

Earlier we wrote about: Top 5 Semiconductor mutual funds

Importance of a ₹1 Crore Term Plan

You might wonder, “Is 1 crore really necessary?” In today’s world, with rising education costs, inflation, and home loans, the answer is often a resounding yes. A ₹1 crore cover isn’t an extravagance; it’s a calculated move to ensure your family’s financial independence. This sum can help your spouse manage daily expenses without dipping into savings, ensure your children’s education plans remain on track, and clear off any outstanding debts like a loan, so your family isn’t burdened by them.

It’s about preserving the life you’ve worked hard to build for them. When you start looking for the best term plan, you are essentially looking for a plan that can effectively become you, financially, for your family when they need it the most.

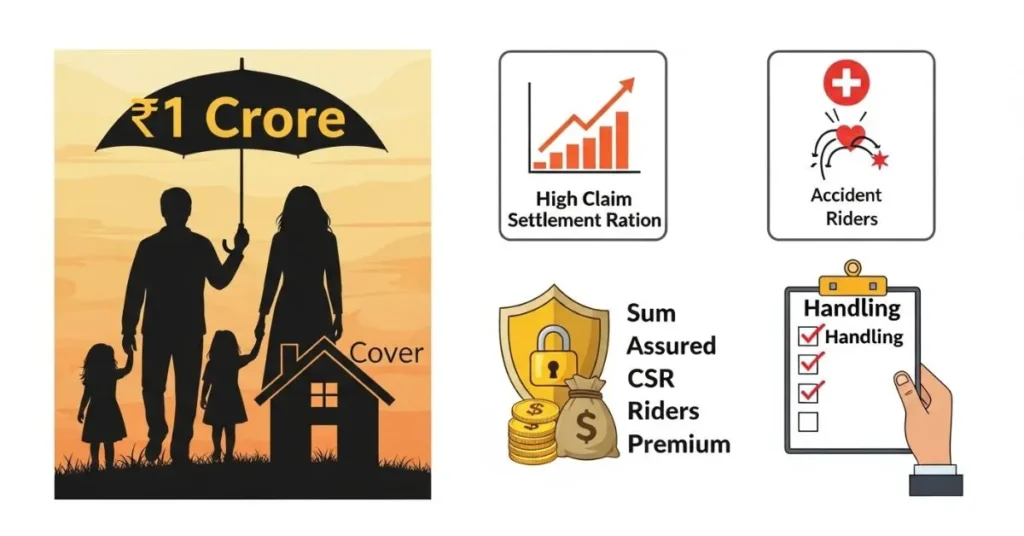

Key Features To Choose Best Term Plans

When you’re searching for the best term plan, look beyond just the cost. The real value often lies in the details. Check if the policy can cover you into your later years, like until 80. See if you can pay off the premiums in a shorter span—say, 15 years—while staying protected for 30. And don’t overlook the add-ons, or ‘riders’. These let you tailor the plan to your life, adding crucial layers of protection like critical illness cover. It’s these features that transform a standard policy into your personal safety net.

- Critical Illness Rider: This is almost a must-have today. It pays a lump sum if you are diagnosed with a specified critical illness (e.g., cancer, heart attack), helping you manage treatment costs without eroding your savings.

- Accidental Death and Disability Benefit Rider: This provides an additional payout if death occurs due to an accident, or it pays a percentage of the sum assured in case of a permanent disability.

- Waiver of Premium Rider: This is a fantastic feature. If you are diagnosed with a critical illness or become disabled, this rider ensures that all your future premiums are waived off, but your policy continues uninterrupted.

Comparison of Leading Insurers for ₹1 Crore Term Plans

The Indian insurance market has several strong players, each offering a competitive best term plan for 1 crore. Here’s a quick look at some of the prominent names:

| Insurer | Plan Name | Key Highlight |

|---|---|---|

| LIC | Tech Term Plan | Backed by the trust and high claim settlement ratio of LIC, it’s a straightforward and reliable option. |

| HDFC Life | Click 2 Protect 3D | Offers multiple plan variants and extensive rider options for customised coverage. |

| ICICI Prudential | iProtect Smart | Known for its comprehensive in-built critical illness cover and user-friendly online process. |

| Max Life | Smart Term Plan | Often competes with very competitive premiums and a strong claim settlement record. |

| SBI Life | eShield | A simple, pure term plan that is easy to understand and purchase online. |

| Bajaj Allianz | Smart Protect Goal | Focuses on goal-based protection and offers flexibility in terms of coverage and payouts. |

The best term plan for 1 crore for you will depend on which insurer’s philosophy and plan features align best with your personal needs and health profile.

Evaluating Claim Settlement Ratios: What They Mean for You

This is perhaps the most critical chapter in your decision-making book. The Claim Settlement Ratio (CSR) is the percentage of claims an insurer has paid out in a year against the total number of claims received. Simply put, if an insurer has a CSR of 98%, it means they paid 98 out of 100 claims. A high CSR (above 95%) is a strong indicator of the insurer’s reliability and willingness to honour its promises.

While you should certainly look for companies with a consistently high CSR, also check the amount of claims they have rejected and the reasons for it. This data is published annually by IRDAI and is publicly available. Opting for a best term plan from an insurer with a high CSR drastically increases the confidence that your family’s claim will be settled smoothly.

Cost Analysis: Premiums for ₹1 Crore Term Plans

The premium for a best term plan is not a fixed number. It depends on your age, health, whether you smoke, your profession, and the policy term. To give you a rough idea, a healthy 30-year-old non-smoker can typically secure a best term plan for 1 crore with a 30-year policy term for an annual premium ranging from approximately ₹8,500 to ₹12,000. The key is to buy early. A 25-year-old will pay significantly less than a 35-year-old for the exact same cover. It’s always wise to use online premium calculators to get instant quotes from multiple insurers and compare them side-by-side.

Common Myths About Term Insurance

Many people avoid term insurance due to misconceptions. Let’s bust a few:

- Myth 1: “It’s a waste of money if I don’t die during the term.” Truth: It’s not a lottery; it’s risk coverage. You pay a car insurance premium yearly hoping never to make a claim. Term insurance is similar—it’s for peace of mind.

- Myth 2: “I’m young and healthy, I don’t need it.” Truth: This is the perfect time to buy! Premiums are lowest when you are young and healthy.

- Myth 3: “The claim process is too complicated.” Truth: Insurers with high CSRs have streamlined their claim processes significantly. Keeping your nominee informed and your documents in order simplifies it further.

Tips for Choosing the Right Term Plan for Your Needs

Finding the best term plan is a personal journey. Start by being honest about your financial liabilities and your family’s future needs. Use online comparison tools but don’t rely solely on them. Read the policy wordings carefully, especially the exclusions. Be transparent about your health and habits during the application to avoid issues later. Finally, think long-term. Choose a policy and an insurer you will be comfortable with for the next 30-40 years.

Conclusion: Making an Informed Decision on Term Insurance

Choosing the right term plan is one of the most responsible financial decisions you will ever make. It’s a silent guardian for your family’s dreams and aspirations. By focusing on adequate coverage (a best term plan for 1 crore is a great benchmark), a reputable insurer with a high claim settlement ratio, and useful riders, you can move beyond the confusion and select a plan that truly secures your family’s future. Remember, this isn’t just about a document; it’s about delivering on your love and promises, no matter what life throws your way. Take a step today to research, compare, and invest in that peace of mind.

Disclaimer: This is for information only. Please consult a financial advisor for personalized advice.

FAQs Related to Best Term Plan

1.Which is the best term insurance plan?

Top picks for 2025: HDFC Life Click 2 Protect Super and ICICI Pru iProtect Smart offer high claim settlement ratios (99%+) and robust rider options. Choose based on coverage needs, premium affordability, and rider benefits.

2.Is it good to take a term plan?

Yes, term insurance is highly recommended for individuals with dependents and financial liabilities—it offers large coverage at low premiums. It’s a pure protection tool, not an investment, ensuring your family’s financial security if you’re not around

3.What is the cost of 1 crore life insurance?

A ₹1 crore term life insurance plan typically costs ₹15–₹25/day for healthy individuals aged 25–35. Premiums vary by age, health, tenure, and insurer—LIC, Bajaj Allianz, and HDFC Life offer competitive optionsDitto Insurance+1.