In the dynamic world of mutual funds, few have demonstrated the resilience and consistent performance of the Parag Parikh Flexi Cap Fund (PPFCF).For anyone who started investing a few thousand rupees each month a decade ago, the Parag Parikh fund did more than just sit in their portfolio. It became a dependable partner, quietly building their modest savings into a much larger amount—the kind that can actually change your life.

The Parag Parikh Flexi Cap Fund stands out for a simple reason: it sticks to a sensible and straightforward investment plan.. In a world of wild buying and selling, this fund has shown the remarkable power of staying calm, thinking long-term, and looking beyond our borders for opportunity. It’s the kind of fund you can invest in and then, for the most part, stop worrying about.

Table of Contents

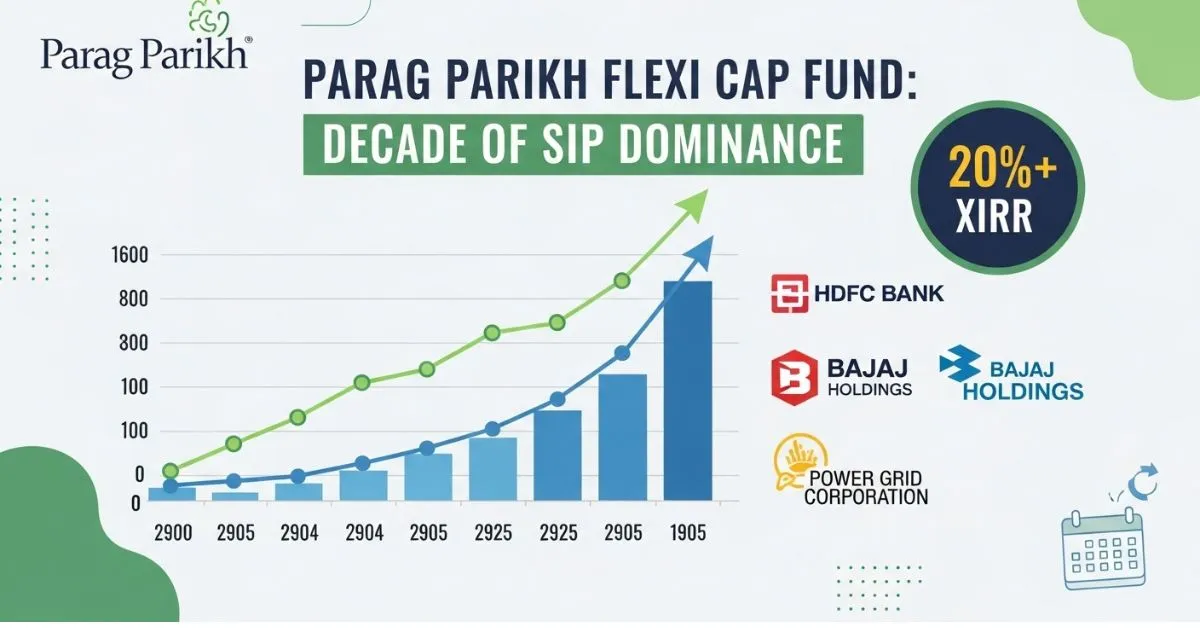

SIP Performance: Over 20% XIRR

We’ve all heard the saying, “It’s not about timing the market, but time in the market.” The Parag Parikh Flexi Cap Fund is living proof of that. The numbers are genuinely impressive, but it’s the real-world impact that hits home. Over the past ten years, a Systematic Investment Plan (SIP) in this fund has delivered returns (XIRR) of over 20%. Now, let’s translate that from financial term into something we can all understand.

Imagine back in 2015, you decided to set up a monthly SIP of ₹10,000, You keep at it, through market highs and lows, trusting the process. Fast forward to today, and that consistent ₹10,000 would have grown into a staggering amount of approximately ₹34.5 lakh. Let that sink in. Your total investment would have been ₹12 lakh, but the powerful combination of compounding and the skilled management of the Parag Parikh Flexi Cap Fund would have more than doubled your money. That’s the kind of change you get with a good fund and patient investing.

Earlier we wrote about: Best international Mutual funds

Fund Management: A Legacy of Expertise

A great fund doesn’t run on autopilot; it’s driven by people with a clear vision. Steering the ship at the Parag Parikh Flexi Cap Fund is Neil Parag Parikh. With over two decades of experience, Neil isn’t the kind of fund manager who gets swayed by every market rumor or short-term trend. His approach is grounded in good old-fashioned value investing. This means the team is essentially on a constant hunt for wonderful companies they can buy at a reasonable price, and then they have the patience to hold them for years. This long-term perspective has been a guiding light, helping the fund navigate economic downturns and bull markets with equal poise.

Portfolio Composition: A Balanced Approach

Ever been curious about where your money actually goes? The Parag Parikh Flexi Cap Fund doesn’t put all its eggs in one basket. It holds a diverse mix of nearly 200 stocks, but its major bets are in some of India’s most recognizable and stable companies. Its top holdings include giants like HDFC Bank, Bajaj Holdings, Power Grid, Coal India, and ICICI Bank. This spread across banking, energy, and investments shows the fund’s flexible strategy—it’s not married to any single sector and is free to go where the best opportunities around.

Here’s a simple table for those holdings:

| Company | Allocation (%) |

|---|---|

| HDFC Bank Ltd. | 7.93% |

| Bajaj Holdings & Investment Ltd. | 5.90% |

| Power Grid Corporation of India Ltd. | 5.89% |

| Coal India Ltd. | 5.28% |

| ICICI Bank Ltd. | 4.95% |

Global Exposure: A Strategic Edge

Here’s a feature that makes the Parag Parikh Flexi Cap Fund truly special: it can invest up to 35% of its money in international stocks. In a world that’s more connected than ever, this is a brilliant move. It does two crucial things. First, it provides a cushion; if the Indian economy hits a rough patch, the global investments can help balance things out. Second, it lets you, as an Indian investor, own a piece of fantastic global companies.

Some investors worry about recent regulations that cap how much a fund can invest overseas, wondering if it will hurt performance. But the management at the Parag Parikh Flexi Cap Fund has shown it can strategically manage within these limits without missing a beat. Their expertise in picking the right global stocks ensures this cap doesn’t hold the fund back.

Rolling Returns: Consistency Over Time

Anyone can have a lucky year, but what separates a good fund from a great one is performance you can count on, year after year. This is where the Parag Parikh Flexi Cap Fund really earns its stripes. If you look at its “rolling returns,” which is a way to check performance across all possible time periods, the story is clear. Over every 3-year, 5-year, and 9-year period you can look at, the fund has delivered average returns hovering around a remarkable 19%. This consistency tells you that the fund isn’t a flash in the pan; it’s a reliable wealth-builder built for the long run.

Assets Under Management (AUM): A Testament to Trust

You know a fund has earned people’s confidence when you look at the sheer amount of money it manages. The Parag Parikh Flexi Cap Fund currently oversees a massive ₹1,15,040 crore in assets. This isn’t just a big number; it’s a vote of confidence from millions of investors who trust the fund with their hard-earned money. It also demonstrates the fund’s capability to manage such a large pool efficiently, without its size becoming a drag on performance. For those looking to maximize their gains, opting for the Direct Plan of the Parag Parikh Flexi Cap Fund is a no-brainer, as it cuts out extra fees and lets more of your money work for you.

Conclusion:

So, after a decade of proven track record, where does the Parag Parikh Flexi Cap Fund stand? If you’re an investor looking for a solid, core holding for your portfolio—one that blends the stability of Indian giants with the exciting potential of global markets—then this fund remains a fantastic choice. Its story is one of consistency, disciplined management, and a simple, effective strategy. It’s the kind of fund that allows you to invest with peace of mind, knowing your future is in steady hands.

Disclaimer:This content is for information only and not financial advice. Please consult a financial advisor before investing.

FAQs About Parag Parikh Flexi Cap Fund

1.Is Parag Parikh Flexi Cap Fund good now?

Parag Parikh Flexi Cap Fund is among the few flexi-cap schemes with positive 1-year returns (3.53%) despite market pressure. Its long-term performance remains strong, with 5-year annualized returns over 21%.

2.Parag Parikh Flexi Cap Fund NAV today?

As of September 29, 2025, the NAV of Parag Parikh Flexi Cap Fund is ₹84.6453 for the Regular Plan. The Direct Plan NAV was ₹93.1763 as of September 25, 2025.

3.Why is the Parag Parikh Flexi Cap Fund so famous?

Parag Parikh Flexi Cap Fund is renowned for its consistent long-term returns and unique global diversification strategy. Its value-investing approach and low expense ratio attract savvy investors.

4.What is the return of Parag Parikh Flexi Cap Fund for 3 years?

The Parag Parikh Flexi Cap Fund has delivered a 3-year annualized return of approximately 18.5% as of September 2025. This reflects its strong performance across domestic and global equity holdings.