Feeling overwhelmed by investment talk? Understanding the 4 types of mutual funds is your perfect starting point. It’s true, everywhere you turn someone is telling you to invest, but it’s hard to know where to begin. For so many of us in India, mutual funds have been the answer because they let you start without being a stock market guru. Picking the right one is the difference between a stressful journey and a smooth ride to your financial goals.

Each of the 4 types of mutual funds is a different vehicle built for a specific path. As we head into 2025, getting a clear, simple grasp of these types is your most powerful first move. Let’s break them down in plain English.

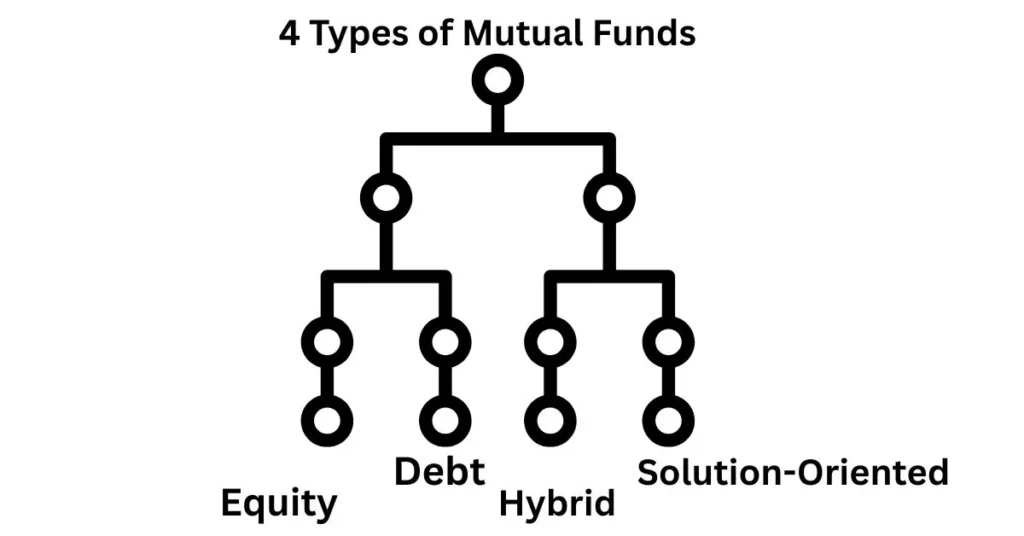

4 Types of Mutual Funds With Examples :

Let’s dive into the four main characters in the mutual fund story: Equity, Debt, Hybrid, and Solution-Oriented a 4 types of mutual funds. It’s like having a team where each player has a special skill. Your job is just to know who to put in the game and when.

1. Equity Funds: For When You’re Playing the Long Game

You know how people talk about “owning a piece of a company”? That’s exactly what equity funds let you do. They pool your money with other investors to buy shares in a bunch of different companies.They’re perfect if you’re in your 20s or 30s and saving for something big down the road—like retirement.

The thing to remember is that these funds are tied to the stock market. So, their value will have good years and not-so-good years. It’s a bit of a rollercoaster, but if you can stay on for the long ride (think 10-15 years), they have the best chance of building real wealth. A solid example is something like the SBI Bluechip Fund, which focuses on big, established companies you probably already know.

2. Debt Funds: Your Calmer, Steadier Friend

Now, if the thought of that stock market rollercoaster makes you nervous, you’ll probably prefer debt funds. These are the steady Eddies of the investing world among 4 types of mutual funds. Instead of buying company stocks, they loan money to governments or solid companies by buying their bonds.

You won’t see dramatic, overnight growth here. What you get is much more stability, which is perfect when you’re saving for a goal that’s just a couple of years away—like a wedding, a car, or a house down payment. Your money is less likely to take a sudden dive. A good one to look at is the HDFC Short Term Debt Fund, which is a popular choice for this kind of safer, short-term parking of your savings.

3. Hybrid Funds: The Best of Both

Can’t decide between the growth of stocks and the safety of bonds? You don’t have to! Hybrid Funds do the mixing for you. They combine stocks and bonds in a single fund. This makes them a fantastic “middle path” for someone who wants growth but also wants to sleep well at night. They’re great for medium-term goals, like saving for a child’s college education that’s 5-7 years away. The ICICI Prudential Equity & Debt Fund is a classic example that aims to balance both worlds.

4. Solution-Oriented Funds: The Goal-Specific Planners

Some goals are too important to leave to chance, like your retirement or your child’s wedding. Solution-Oriented Funds are built specifically for these big life events. They often come with a lock-in period (meaning you can’t withdraw your money for a set number of years), which actually helps you stay disciplined. A good example is the HDFC Retirement Savings Fund, which is designed to help you build a retirement corpus by automatically managing the risk for you over time.

Which Mutual Fund Type is Best Among the 4 Types of Mutual Funds?

This is the big question, and the honest answer is: it depends entirely on you. There’s no one-size-fits-all “best” option among the 4 types of mutual funds every 2025 investor must know about.

Ask yourself: What am I investing for? If it’s long-term wealth creation and you can handle some ups and downs, equity funds are often the recommended path. If you need stability for a short-term goal, debt funds are safer. If you want a middle ground, hybrid funds are fantastic. And if you need a disciplined plan for a major goal, a solution-oriented fund is the way to go. Your goal, timeline, and personal comfort with risk are what determine the true “best” choice.

Earlier We Wrote About :Best flexicap fund

Which is the Safest Type of Mutual Fund?

You know when you’re looking for a place to put your money where you won’t lose sleep over it? For most investors, that place is debt funds among 4 types of mutual funds. They’re like the sensible, reliable friend in your investment group—the one who prefers a steady, predictable path over rollercoaster rides. Instead of chasing hot stocks, they focus on lending to stable borrowers like the government or solid companies, which makes them a much calmer place to park your savings.

Now, let’s keep it real—no investment is ever completely risk-free. Even debt funds can have off days if interest rates jump around. But if your main goal is to keep your initial investment safe while still earning a little something extra, especially for goals that are just a year or two away, debt funds are generally your best and most straightforward choice.

Conclusion :

The world of investing doesn’t have to be complicated. By getting familiar with the 4 types of mutual funds every 2025 investor must know about, you’re already ahead of the game. The key is to match the fund to your personal financial journey. Take a moment to think about what you really want your money to do for you. That simple reflection will make choosing the right path from these 4 types of mutual funds feel surprisingly straightforward.

Disclaimer: The information above is for educational purposes only and is not a recommendation to buy or sell any mutual fund. Always do your own research or consult a financial advisor before making investment decisions.

FAQs About 4 Types of Mutual Funds :

1.What are the 4 pillars of mutual fund?

The four pillars of mutual funds are liquidity, diversification, professional management, and affordability. These elements help investors access a broad range of assets with expert oversight at a relatively low cost.

2.What are good mutual funds for beginners?

Good mutual funds for beginners in India include SBI Long-Term Equity Fund and HDFC Balanced Advantage Fund, offering growth with tax benefits and moderate risk. These funds are ideal for new investors seeking diversification and professional management.

3.Which mutual fund is best?

The best mutual fund depends on your goals, but Parag Parikh Flexi Cap Fund and Mirae Asset Large Cap Fund are top choices for long-term growth. They offer strong performance, diversification, and are suitable for both beginners and seasoned investors.

4.What is an ETF fund?

An ETF (Exchange-Traded Fund) is a type of investment fund that trades on stock exchanges like a regular stock. It holds a diversified portfolio of assets, offering low-cost exposure to various markets.