Starting your investment journey can feel overwhelming. With so many options, a common question pops up: should I put my money in mutual funds or stocks? This debate of mutual funds vs stocks is a classic one for a reason. Both can help you build wealth, but they suit different kinds of people.

If you’re new to this, making the right choice now can set you up for success later. This guide will break down mutual funds vs stocks in simple terms to help you decide.

What Are Mutual Funds?

Imagine you and a bunch of friends pool money to hire a professional chef to cook a fantastic meal. A mutual fund works in a similar way. It pools money from many investors like you. A professional fund manager then uses that pool to buy a diversified basket of stocks, bonds, and other assets.

Key Features:

- Managed by experts

- Spreads investment across many companies (diversification)

- Available through SIPs (Systematic Investment Plans) starting as low as ₹500/month

Types of Mutual Funds:

- Equity Mutual Funds – Invest mainly in company shares (higher risk, higher return)

- Debt Mutual Funds – Invest in bonds and fixed-income securities (lower risk, stable return)

- Hybrid Funds – Mix of equity and debt (balanced risk)

For beginners, mutual funds are a safe and convenient way to start investing without needing deep market knowledge.

Earlier We Wrote About : best midcap funds in India 2025

What Are Stocks?

Buying a stock means buying a small piece of ownership in a single company, like Reliance or TCS. If the company does well and becomes more valuable, so does your piece of it. You can also earn a share of the profits, called dividends.

Key Features:

- Direct ownership in a company

- Returns depend on company performance and market conditions

- Can generate dividends in addition to price appreciation

Ways to Invest in Stocks:

- Direct Buying: Purchasing shares individually through a Demat account

- Stock SIPs: Some brokers allow monthly stock investments, similar to mutual funds

For beginners, stocks offer high potential returns but require active monitoring and research.

Mutual Funds vs Stocks: Key Differences :

| Factor | Mutual Funds | Stocks |

|---|---|---|

| Risk Level | Moderate (diversified) | High (depends on single company) |

| Returns | 10–14% on average (long term) | Can be very high or very low |

| Knowledge Needed | Minimal (managed by experts) | High (need research & analysis) |

| Time Involvement | Low | High |

| Diversification | Built-in | You need to diversify yourself |

| Entry Point | As low as ₹500 via SIP | Generally higher (buying per share) |

Mutual Funds vs Stocks Pros and Cons :

✅ Pros of Mutual Funds :

- Professional Management – Expert fund managers make investment decisions for you.

- Diversification – Spreads money across many companies, reducing risk.

- Low Entry Barrier – Start small with SIPs from ₹500/month.

- Long-Term Wealth Creation – Encourages discipline and benefits from compounding.

❌ Cons of Mutual Funds :

- Expense Ratio – Management fees and charges reduce overall returns.

- Less Control – Investors cannot choose individual stocks; decisions are made by the fund manager.

- Manager Dependency – Performance heavily relies on the skills of the fund manager

✅ Pros of Stocks :

- High return potential – Strong companies can deliver big gains over time.

- Full control – You decide what to buy, hold, or sell in your portfolio.

- Dividend income – Some stocks provide regular payouts in addition to growth.

- Benefit from company growth – Shareholders directly gain as businesses expand.

❌ Cons of Stocks :

- High volatility – Prices can rise or fall sharply in short periods.

- Research required – Success depends on analysis and market tracking.

- Emotional stress – Daily swings can lead to fear-driven decisions.

- Low diversification – Few stocks mean higher risk if one performs badly.

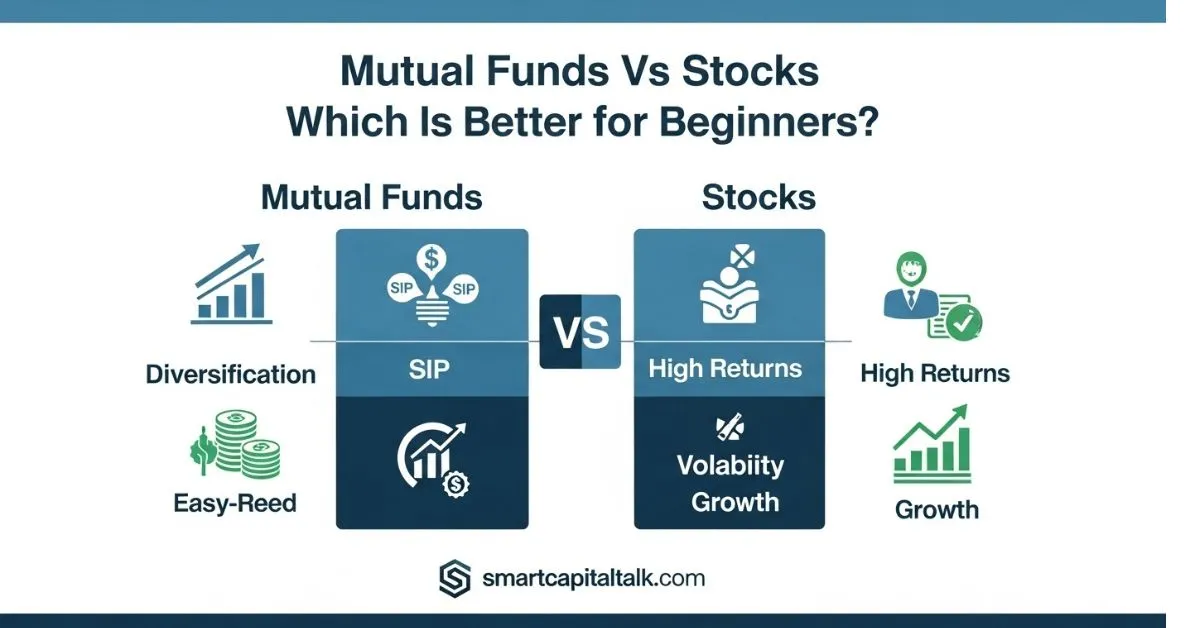

Mutual Funds vs Stocks Which Is Better for Beginners?

For most beginners, mutual funds are the safer starting point. They need less effort, provide diversification, and build discipline through SIPs. Once you gain confidence, you can add some stocks.

👉 Smart Strategy: Begin with mutual funds, Once you’re confident and have some knowledge, you can allocate a small portion to stocks.

Example: If you earn ₹50,000 and invest ₹10,000, you might put ₹7,500 in mutual funds and ₹2,500 in stocks for balance.

Click here to Invest in mutual funds vs stocks :https://groww.in/

Conclusion :

For beginners, mutual funds are the best first step—they’re simple, safe, and disciplined. Once you’re comfortable, add some stocks for higher growth potential. The key is to start early, invest consistently, and stay patient.

Disclaimer: The information above is for educational purposes only and is not a recommendation to buy or sell any mutual fund. Always do your own research or consult a financial advisor before making investment decisions.

1.Are mutual funds better than stocks?

Mutual funds offer diversification and professional management, making them ideal for passive investors. Stocks can yield higher returns but carry greater risk and require active monitoring. The better choice depends on your financial goals, risk tolerance, and investment styl

2.Which is riskier: stocks or mutual funds?

Stocks are generally riskier due to their volatility and lack of diversification. Mutual funds spread risk across multiple assets, reducing exposure to any single investment. However, risk levels vary by fund type and stock choice, so investor strategy matters

3.What is the safest type of investment?

Government bonds are considered among the safest investments due to their low risk and guaranteed returns. They’re backed by the government, making default highly unlikely. Ideal for conservative investors seeking stability over high returns.

4.Which is better SIP or stocks?

SIP (Systematic Investment Plan) offers disciplined investing in mutual funds with lower risk and steady growth. It’s ideal for long-term goals and suits investors who prefer consistency over market timing.