Hindustan Unilever Limited (HUL) continues to be a cornerstone of India’s FMCG sector. Hindustan Unilever Share Price finding strong support near ₹2,200 and facing stiff resistance around ₹2,800, investors are watching closely to see if this range-bound stock is finally ready for a breakout after years of consolidation.

This blog covers HUL’s past performance, reasons for its sideways trend, possible triggers for a breakout, technical insights, investor implications, and why it still remains a long-term wealth compounder.

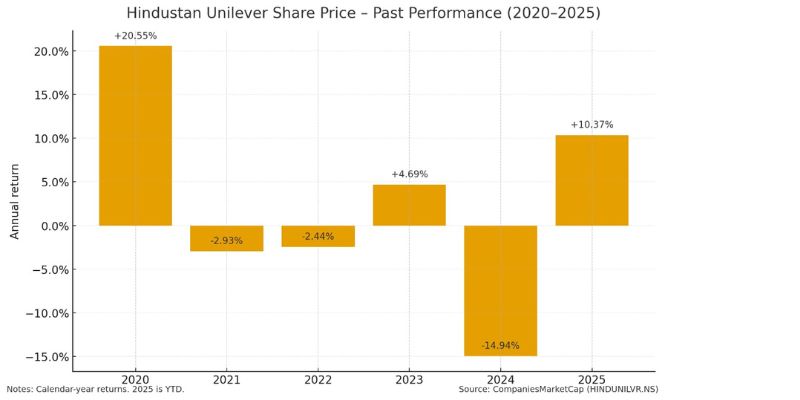

Hindustan Unilever Share Price Past Performance (2020–2025) :

Over the past five years, the Hindustan Unilever Share Price has largely moved between ₹2,000 and ₹3,000, delivering a cumulative return of about 34%.

- 2020–2021: Pandemic-driven demand lifted the stock near ₹2,800.

- 2022–2023: Inflation and competition pushed it below ₹2,200.

- 2024–2025: Recovery phase, with YTD gains of ~11.7%.

The stock’s 52-week high is ₹3,035 and the low is ₹2,136, highlighting stability despite volatility. Importantly, HUL maintained steady dividends, paying ₹24 per share in June 2025, underlining its defensive nature.

Earlier we wrote about : Top 5 Best Flexi cap Fund

Why Hindustan Unilever Share Price Has Been Range-Bound :

Hindustan Unilever Share Price sideways trend can be explained by several factors:

- High Competition: New-age and local FMCG brands have taken market share.

- Economic Pressures: Inflation, supply chain issues, and raw material costs weighed on margins.

- Investor Shift: Preference for high-growth tech stocks diverted funds away from defensive FMCG stocks.

- Modest Growth: Sales grew around 9.6% while volume growth was just 2% in FY25.

For stability-focused investors, Hindustan Unilever remains attractive, but growth investors found it underwhelming.

What Could Trigger a Breakout in 2025 ?

Several catalysts could push the Hindustan Unilever Share Price beyond its range:

- Recovery in rural and urban demand, aided by GST rationalizations.

- Better-than-expected Q1FY26 results with strong revenue growth.

- Smooth execution of mergers like the ice cream demerger.

- Investments in premium categories and future segments.

- Easing inflation and stable input costs.

- Lower GST rates on essentials could boost HUL’s volumes and strengthen its breakout potential in 2025.

If these factors align, HUL could break past resistance and aim for new highs.

Technical Analysis: HUL’s Chart Patterns :

From a technical perspective, HUL is showing encouraging signs:

- Chart Patterns: A reverse head and shoulders breakout around ₹2,749.

- Support & Resistance: Strong support at ₹2,150-2200; resistance near ₹2,800–₹3,000.

- Indicators: Stock is trading above key moving averages with bullish RSI signals.

A decisive close above ₹2,800 with high volume could unlock targets of ₹3,200–₹3,400.

View charts on Tradingview Click here: https://www.tradingview.com/

What a Breakout Means for Investors :

If Hindustan Unilever Share Price breaks out above resistance, investors could see 20–30% upside in the short term.

- Long-Term Holders: Breakout would finally reward patient investors.

- Short-Term Traders: Clear buy opportunities after resistance is crossed.

- Dividend Seekers: Continue enjoying stability with added growth potential.

However, beware of false breakouts—volume confirmation is key.

Why HUL Remains a Wealth Compounder ?

Even during consolidation, Hindustan Unilever remains a wealth compounder because of:

- Strong Portfolio: 40+ household brands, with focus on premiumization.

- Dividend Reliability: Consistent payouts supported by solid cash flows.

- Market Leadership: Over ₹5 lakh crore market cap, backed by Unilever Plc.

- Resilience: Ability to withstand competition and economic swings.

For long-term investors, Hindustan Unilever Share continues to deliver steady compounding.

Conclusion :

In 2025, Hindustan Unilever Share Price is at a crucial turning point. After five years of consolidation, improving fundamentals, favorable macros, and bullish technicals suggest that a breakout may be near.

For investors, this could mean significant upside potential, reaffirming HUL’s reputation as one of India’s most reliable wealth builders. Keep an eye on ₹2,800–₹3,000 levels for confirmation

⚠️ Disclaimer :

This article is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before investing.